🧠 Smart Money Concepts (SMC) Explained: A Complete Guide for Forex Traders

📘 Introduction: What Are Smart Money Concepts?

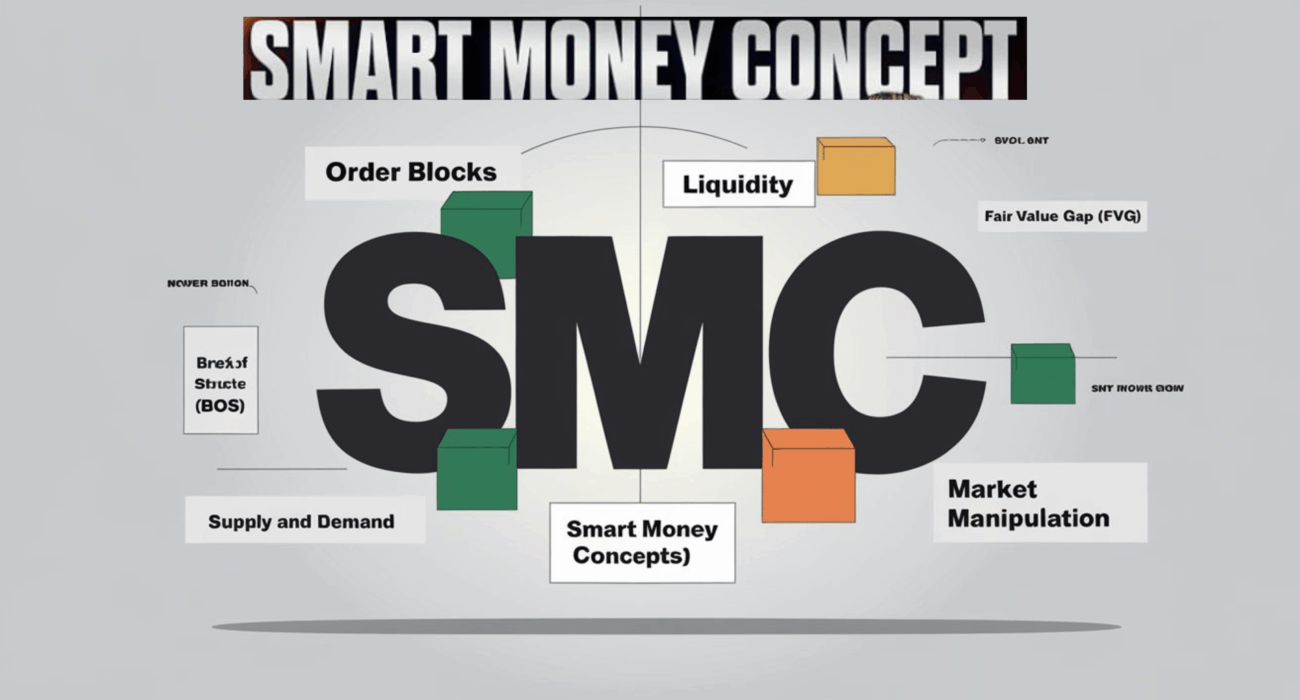

Smart Money Concepts (SMC) is a trading methodology based on the belief that financial institutions — not retail traders — drive the forex market.

Rather than relying on traditional technical indicators, SMC focuses on liquidity, market manipulation, and institutional behavior, giving you a clearer view of where the market is headed.

🧠 Goal: Trade with the smart money — not against it.

This guide breaks down the most important SMC tools and how to apply them in your trading strategy.

🟦 Why Traditional Retail Strategies Fail

Most retail traders rely on:

-

Trendlines

-

Moving averages

-

RSI/Stochastic

-

Support/resistance

-

Chart patterns (head & shoulders, flags)

While not useless, these tools often lag and ignore the true source of price movement: institutional orders and liquidity grabs.

That’s where Smart Money Concepts come in — to help you anticipate real intentions behind price action.

🔍 Key Smart Money Concepts (SMC) You Must Know

1️⃣ Liquidity & Liquidity Pools

Definition: Liquidity is where orders (especially stop-losses) accumulate. Institutions look for liquidity to fill their large orders.

Liquidity Pools Exist At:

-

Previous highs/lows (equal highs/lows)

-

Obvious support/resistance

-

Breakout levels

Institutions often push price into these areas to trigger retail stop-losses — then reverse.

2️⃣ Market Structure

SMC traders use internal market structure to determine trends and shifts in direction:

-

Higher Highs (HH) / Higher Lows (HL) = Uptrend

-

Lower Highs (LH) / Lower Lows (LL) = Downtrend

SMC introduces two advanced terms:

-

Break of Structure (BOS): Confirms continuation of trend

-

Change of Character (CHoCH): Signals trend reversal

Spotting a CHoCH near a key zone is often the first sign smart money is entering.

3️⃣ Order Blocks (OB)

Definition: The last bullish/bearish candle before a major price move caused by institutions.

-

Bullish OB: The last down candle before the price surges upward

-

Bearish OB: The last up candle before a strong drop

These act as zones of interest, where institutions may re-enter.

Pro tip: Wait for confirmation (BOS or candle rejection) before trading from an order block.

4️⃣ Fair Value Gaps (FVG) / Imbalance

Definition: A gap between price wicks caused by aggressive institutional buying/selling.

These imbalances get filled later when the price returns to “rebalance” the market.

Use FVGs to:

-

Predict short-term reversals

-

Confirm entries

-

Align with OBs for sniper setups

5️⃣ Stop Hunts & Liquidity Sweeps

Institutions will often break support or resistance zones only to reverse, trapping retail traders.

Examples:

-

Price spikes below a triple bottom → then reverses bullish

-

Price fakes a breakout above resistance → then crashes

The sweep gives smart money the liquidity needed to enter large trades.

🧠 How SMC Trading Works (Step-by-Step)

🔍 Step 1: Mark Structure & Identify Bias

Are you in a bullish or bearish trend? Look for CHoCH and BOS to confirm your directional bias.

🔍 Step 2: Spot Liquidity Zones

Identify where retail traders are placing their stop-losses — above swing highs, below equal lows, etc.

🔍 Step 3: Wait for a Liquidity Sweep

Don’t enter too early. Wait for price to sweep a liquidity level and shift market structure (CHoCH/BOS).

🔍 Step 4: Find an Order Block or FVG

Once the sweep happens, look for a valid order block or fair value gap to enter your trade.

🔍 Step 5: Execute with Precision

Place your stop below the OB or FVG. Target the next liquidity zone, imbalance, or structural level.

💡 Example SMC Trade Setup:

-

Price is in an uptrend, creating higher highs

-

You identify equal lows (liquidity) under a support zone

-

Price sweeps the lows (stop hunt)

-

A CHoCH forms with a bullish engulfing candle

-

Price returns to a bullish order block

-

You enter long with a stop below OB

-

Target the next high or FVG fill

📊 Tools for SMC Trading:

-

TradingView for structure marking & liquidity zones

-

MT5 for real-time execution

-

SMC indicator plugins (optional)

-

Journals to track your entries and R: R

-

Mentorship to review live trades and setups

✅ Benefits of Smart Money Concepts

-

Enter at premium zones with tight stop-losses

-

Understand why the market moves, not just where

-

Build strategies around institutional logic

-

Higher win-rate setups (when applied with discipline)

🚫 Common Mistakes to Avoid

-

Trading every OB or FVG without confirmation

-

Ignoring CHoCH/BOS before entry

-

Using SMC like retail tools (no patience or confluence)

-

Overtrading after one win

🟢 Want to Learn SMC Live?

At Blue Bull Forex Hub, we teach you:

-

How to read market structure cleanly

-

How to apply SMC in live sessions

-

How to combine OBs, FVGs, and liquidity

-

How to pass the prop firm challenges using SMC setups

📘 Join our Crash Course or 🎯 Enroll in 1-on-1 Mentorship

👉 [Click here to chat with us on WhatsApp]

🔎 FAQ Section

Q: Is Smart Money Concepts legit?

Yes. SMC is based on institutional trading logic and is widely used in professional trading circles.

Q: How long does it take to learn SMC?

With mentorship and proper structure, most traders can grasp SMC within 1–2 months and start refining setups.

Q: What’s the best timeframe for SMC trading?

H1–H4 are most common. For sniper entries, use M15/M5 once higher-timeframe bias is confirmed.

Q: Can I combine SMC with other strategies?

Yes — SMC enhances most styles by improving entry timing, bias clarity, and trade management.