📔 How to Journal Forex Trades: The Secret Weapon for Consistency

📘 Introduction: Why Journaling Makes You a Real Trader

In forex trading, consistency is everything, and journaling is the #1 habit of traders who achieve it.

Whether you’re using Smart Money Concepts, price action, or scalping gold, if you’re not journaling your trades, you’re missing the opportunity to:

-

Discover your strengths and weaknesses

-

Spot patterns in wins and losses

-

Improve discipline and remove emotion

-

Scale what works and eliminate what doesn’t

In this guide, you’ll learn how to set up a simple yet powerful forex trading journal, what to track, and how it can transform your trading results — even if you’re just starting.

🔎 1. What Is a Forex Trading Journal?

A forex journal is a log or document where you record every trade you take, including the setup, reasoning, entry/exit, emotions, outcome, and lessons.

Think of it as your trading mirror. It reflects:

-

What you did right

-

What you did wrong

-

What needs to change

Whether you’re a beginner or aiming to pass a prop firm, a journal will quickly reveal what’s holding you back (and how to fix it).

🧩 2. What to Include in a Forex Trade Journal

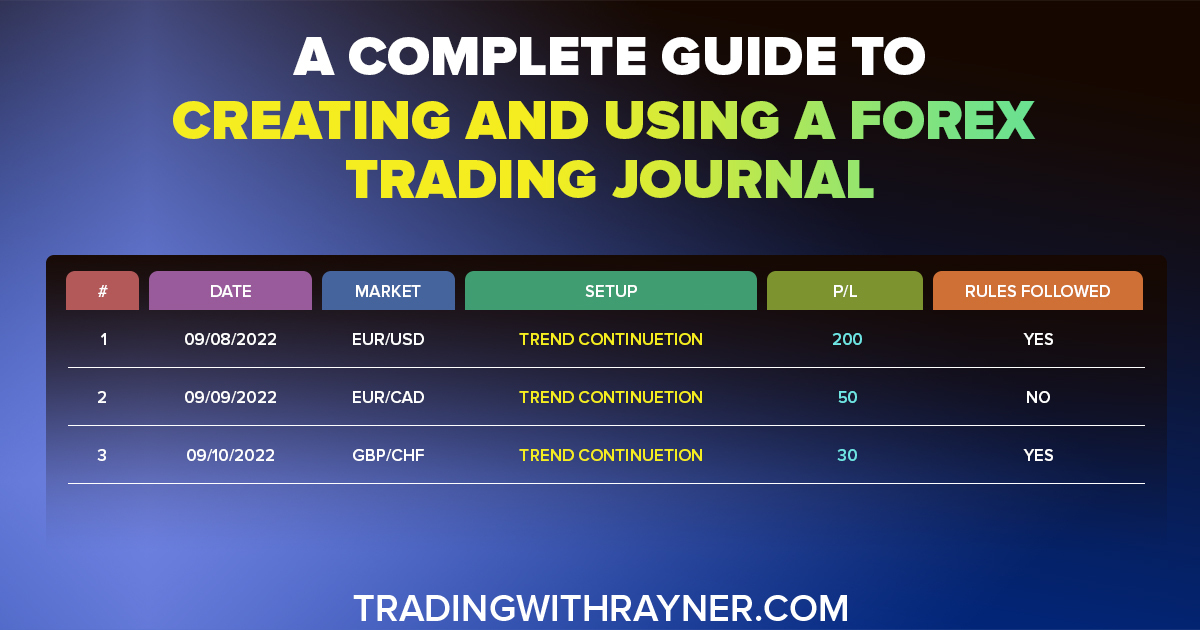

Here’s a simple table layout you can replicate in Excel, Notion, or Google Sheets:

| Entry # | Date/Time | Pair | Direction | Entry | SL | TP | Lot Size | R:R | Outcome | Notes |

|---|

For each trade, you should log:

-

Setup/Strategy Used (e.g., OB + CHoCH)

-

Timeframe

-

Why You Took It

-

Pre/Post-Trade Emotions

-

Mistakes or Lessons Learned

Bonus columns:

-

Screenshot of the chart before and after

-

“Mistake” checkbox

-

Confidence rating (1–10)

-

Screenshot URL (via TradingView)

🔢 3. How Journaling Creates Better Traders

✅ 1. Improves Discipline

When you know you’ll write it down later, you think twice before overtrading or taking impulse trades.

✅ 2. Increases Confidence

You start seeing your edge in action. This builds belief, especially during drawdowns.

✅ 3. Speeds Up Learning

Instead of repeating mistakes, you learn from them. Journals help you spot what’s working faster.

✅ 4. Helps You Pass Prop Firms

Many traders fail challenges due to repeated emotional mistakes. Journaling keeps you structured and accountable.

📸 4. Visual Journaling – Before/After Charting

Attaching annotated charts to your trades is powerful.

Use TradingView screenshots with:

-

Entry and SL/TP marked

-

Explanation (e.g., “Swept liquidity + CHoCH + retest OB”)

-

Post-trade review (Did it follow the plan? What could be better?)

📌 Tip: Save before AND after screenshots — not just winners.

🛠️ 5. Tools to Create a Forex Trade Journal

Here are simple tools to start journaling right now:

🔹 Notion (Free)

Create a custom journal with tables, charts, and screenshots

Great for mobile access and long-form notes

🔹 Excel or Google Sheets

Perfect for structured data and R:R analysis

Add formulas for totals, win rate, and average return

🔹 Edgewonk (Paid)

Advanced tracking with analytics, win-rate charts, and Monte Carlo simulations

Best for full-time or funded traders

🧠 6. Sample Entry: Real Trade Breakdown

Date: June 10, 2025

Pair: XAUUSD

Entry Timeframe: M15

Setup: Asian liquidity sweep → BOS → Retest of M15 OB

Entry: 2315.30 | SL: 2311.30 | TP: 2325.00

Lot Size: 0.10 | R:R: 1:2.5

Result: ✅ TP hit

Emotion: Calm and focused

Lesson: Patience paid off — waited for the structure shift

📌 Add this as a reference model for future gold trades.

🚫 7. Mistakes Traders Make With Journals

| Mistake | Why It Hurts |

|---|---|

| Only journaling winning trades | You learn more from losses |

| Not including emotional context | Emotions drive decisions |

| Journaling too vaguely | You can’t improve what you don’t understand |

| No screenshots | Visual memory is powerful in trading |

🎯 8. How Journaling Fits Into Your Daily Routine

Before Trading:

-

Review the previous day’s trades

-

Set intention (what setups are you waiting for?)

After Each Trade:

-

Log key data

-

Capture a chart screenshot

-

Rate emotional state

End of Week:

-

Review all trades

-

Categorize winners/losses by setup

-

Write a short “Weekly Lessons” summary

📘 How Blue Bull Forex Hub Helps You Journal Like a Pro

When you join our mentorship or course, you get:

-

🧾 Trade journal templates

-

🔎 Feedback on your entries from mentors

-

📊 Weekly trade reviews

-

✅ Accountability sessions to track your growth

-

🛠️ Trade journaling systems for prop firm prep

📍 Remember: Journaling doesn’t just track your progress — it creates it.

🔍 FAQs

Q: Is a trading journal necessary in forex?

A: Yes — it’s one of the fastest ways to build consistency and identify patterns.

Q: What’s the best format to journal trades?

A: A simple spreadsheet or Notion doc works great. Just be consistent and honest.

Q: How often should I review my journal?

A: Daily for new traders. Weekly summaries are great for pattern recognition.

Q: Can journaling help with trading psychology?

A: Absolutely. It helps spot emotional triggers and builds discipline over time.